That Fertile Formula is Inefficient

Why fertility based tax incentives are more efficient when they kick in at the third baby

Bryan Caplan asked for estimates of how his suggested “Number of Kids Federal Tax Adjustment” would impact a country’s total fertility rate. I don’t know if there’s any good information about the size of tax cuts needed to incentivize the median family to have an additional child, but I did my own back of the envelope calculation below anyways. More importantly, I think the structure of his tax adjustment suggestion would make for inefficient spending, so I decided to write my response as a short post so that I could better explain my reasoning for suggesting fertility based tax incentives should kick in starting at the third baby, rather than at the first or second, as discussed here.

I think we’d likely need even bigger tax breaks than what Bryan suggests to motivate the median family to have an extra kid, but that tax breaks for the first or second baby are relatively inefficient. The goal is to find a policy that allows us to pay a lot for babies who wouldn't have been born in the absence of the policy (marginal babies) without paying for too many babies who would've been born anyways. If we have to pay the same amount for every baby born we won’t be able to pay enough per baby to really move fertility rates without making the program unaffordable. Bryan suggests making childless people pay additional tax, in addition to giving people with more than one kid tax breaks, which helps with affordability but doesn’t change my argument with respect to efficiency.

But first, let’s review Bryan’s proposal:

After you calculate your regular federal tax, there’s one final adjustment.

Number of Kids Federal Tax Adjustment

Zero +50%

One +0%

Two -20%

Three -40%

Four -60%

Five -80%

Six+ -100% (income tax-free for life)

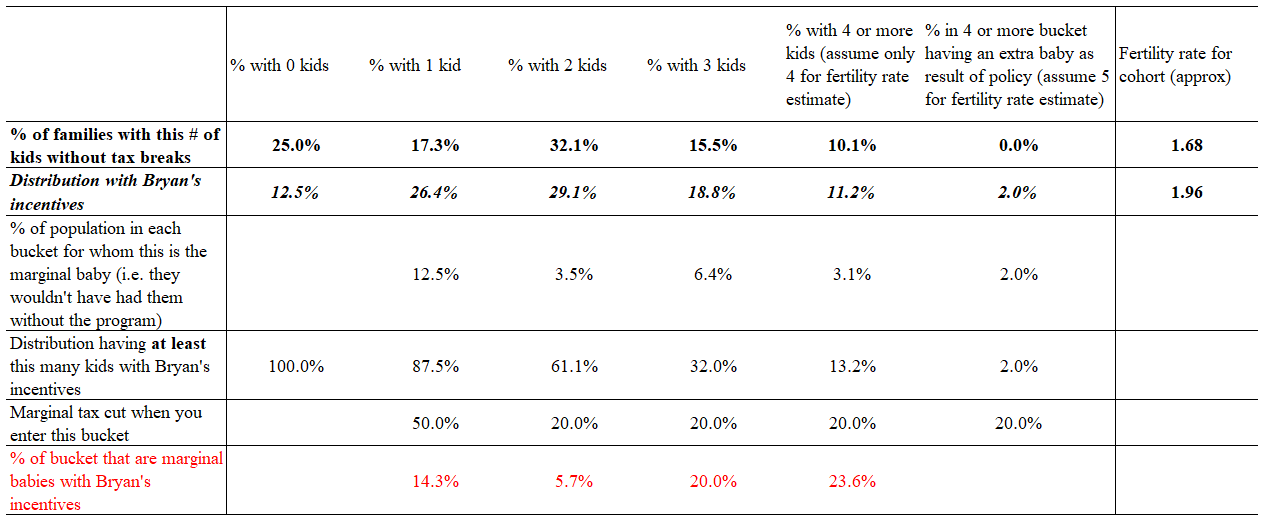

How much might such a program move fertility rates? Based on very small and poor quality anecdotal surveys (in other words, asking a few girlfriends with kids and extrapolating freely) I’d expect that a 50% marginal lifetime tax cut would be enough to incentivize the median family to have approximately one extra baby. For simplicity, I assume that an X% lifetime tax cut (based on current tax bills) would incentivize the Xth percentile family to have one additional baby and that absolute size of tax bill (in other words family income) does not change the percentage tax cut needed to incentivize the family to have an additional baby. This means that a 20% marginal tax cut would be enough to incentivize 20 percent of families who would’ve had only 2 to have 3 instead etc. at any household income level.

Based on the assumption that 25% of women my age will end up childless, I adjusted the latest distribution of the number of children women had by the end of women’s fertility windows (I looked at women 45-50 as of 2022) to estimate the future distribution, in the absence of the policy, for women in my cohort. I then used the assumptions stated above to estimate how this distribution might’ve changed if this policy had been implemented (or was implemented going forward).

See my excel sheet with calcs here, and please check my numbers if you have time!

And given my assumptions this sort of policy would very meaningfully increase fertility, raising the average fertility rate for this cohort from about 1.68 to about 1.96. But this would also lower total tax revenues by about 15% assuming that families of various sizes pay similar amounts of total tax per adult and assuming that people have most of their kids near the start of their meaningful tax paying years (i.e. I’m assuming that people with 2 kids pay 20% less overall, when in reality they’d pay 50% more for a few years and then 0% while they had 1 kid and only get the -20% once they have the second kid). But if we raised taxes on all families with less than 3 kids and then gave larger tax cuts at three plus kids, under the same assumptions we’d be able to incentivize the same increase in fertility rates for a far smaller drop in tax revenue:

Ok, I know, raising taxes 30% for any family with less than 3 kids would not be popular at all. But this example still illustrates that incentives kicking in later would be more cost effective for the same fertility increase, a -1.5% drop in revenue vs. a -15.4% drop. My incentive structure would also make three kids the most common family size, which arguably pushes cultural norms further towards prioritizing larger families.

Now, it might be too politically difficult to argue that childless people, and especially small families, should pay extra taxes. So what if we assumed that no one pays additional tax and kept the absolute size of the incentives the same as in the two examples above. In that case, Bryan’s suggestion would look like the below:

And it would reduce our tax revenues by a whopping 65.4%. Obviously this is not tenable which is why Bryan suggested the need to raise taxes on the childless. My suggestion however, where incentives kick in at the third child and taxes are raised for no one, would only cost a relatively lower 31.5% of revenues:

So, why is it more cost effective to hold incentives off until the third baby? As I said at the outset, we’d ideally only pay for marginal babies. But of course, there’s no way to tell whether any given baby would’ve been born without the financial incentive! So we want to design a policy such that payments (in this case, taxes not collected or taxes refunded) are activated at the point where a relatively high percentage of the babies are marginal, and that percentage is much higher when you get to the third baby than it is for the first or second as I’ll illustrate below using the numbers from the examples above:

To keep things slightly clearer I’ll discuss the numbers assuming no one had a tax hike. With Bryan’s suggested incentive structure, families would get a tax decrease of 50% (based on current tax bills) after they have their first baby. All families get this benefit once they have a baby, and we expect that 87.5% of families would have at least 1 kid with this policy. But only 12.5% out of the 87.5% (so 14.3% of families receiving the tax reduction) would be getting this for a marginal baby, meaning most of those tax incentives would go to families that would’ve had that baby anyways. This ratio gets far worse with the second baby, since most families choose to have at least one more kid once they’ve had the first one. In that case, we’d be giving an additional 20% tax reduction (again based on current unadjusted tax bills) to 61.1% of families, where the second baby is the marginal baby for only 3.5% of the 61.1% (so 5.7%) of families in the bucket.

The same output with my suggested incentive structure is:

With my suggested incentive structure, families would get a tax decrease of 55% (based on current tax bills) after they have their third baby. All families get this benefit once they have a baby, and we expect that 43.2% of families would have at least 3 kids with this policy. And a relatively high 17.6% out of the 43.2% (so 40.8% of families receiving the tax reduction) would be getting this for a marginal baby. This ratio stays near 40% for the fourth baby as well.

I do think there are other considerations, such as whether incentivizing the first baby is especially high value since once a couple has one they’re more likely to have two, which a commenter suggested in response to my previous post on the topic. But I think that it’s also plausible that the would-be childless would require a significantly larger incentive to go from 0 to 1 than that needed to incentivize a family to move from 1 to 2 or 2 to 3 (although I’ve assumed here that the marginal incentive needed to encourage one additional baby than the median family would’ve had otherwise is constant with respect to number of baseline children).

This is not meant to be a policy suggestion, but rather to highlight, in painful detail, an aspect of any solution which I think is often not considered, namely the percentage of the total tax benefits that are directed to families for their marginal baby rather than babies they would’ve had even in the absence of such incentives.

Very well reasoned post. I do lament the the shrinking population. Are there any solutions that do not involve government or taxes? I'm concerned that any solution to this problem will involve government intervention. We don't need so-called "experts" from government agencies proposing tax incentives. In a free society, taxes should only be for revenue to fund essential functions. Incentives only give incentives to government to continue its social engineering.

We as individuals and families must show how rewarding a bigger family can be. Keep up the good work.

1) Paying per child makes everyone with at least one child a potential supporter of the program.

2) Paying per child naturally scales. Someone with three kids gets 3x the benefit of someone with one kid.

3) Paying per child lines up with the "point" of the reform. To internalize the external value of childbearing from society to the parents.

https://www.investopedia.com/articles/personal-finance/090415/cost-raising-child-america.asp

The cost of raising a child is $310,605, or $17,000 a year. This is higher in higher income areas.

And as a parent I can attest this is only the financial cost. There is a lot of unpaid labor in that number.

The goal should be to make having children financially neutral. Children produce surplus value for society, if we share more of that with parents they will have more children.

4) Old's get $15,000 in Medicare a year and $24,000 or so in Social Security. They also get Medicaid and lots of other tax breaks. So we spend a lot more on olds then it would cost to fully fund the expenses of having more children.